9 Ways Dentists Can Maintain Financial Stability for Retirement – Dental Economics

For dentists, planning for retirement is as essential as maintaining patients’ oral health. With years of dedicated labor ahead, ensuring financial stability is critical to enjoying a comfortable, stress-free retirement. Whether you’re just starting your dental career or approaching your golden years, understanding effective strategies for retirement financial planning can empower you to make wise decisions. In this article, we explore 9 ways dentists can maintain financial stability for retirement with insights inspired by Dental Economics.

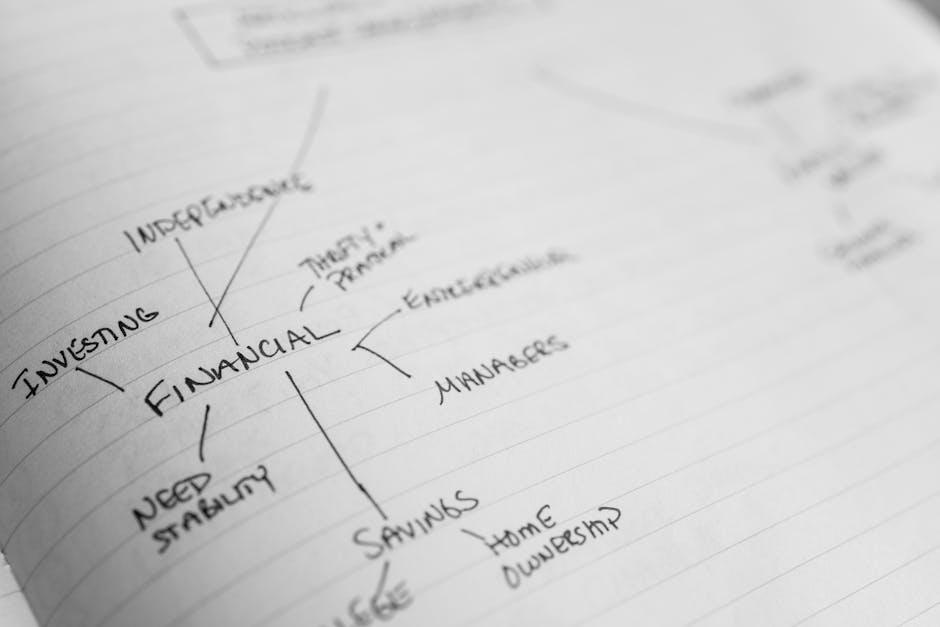

Why Financial Planning is Crucial for Dentists’ Retirement

Dentistry is a rewarding but demanding profession that may involve unique financial challenges including fluctuating income, student debt, overhead costs, and business management. Without strategic financial planning, many dentists risk running out of resources post-retirement or facing an unexpected drop in lifestyle quality. By adopting smart habits and proactive approaches early on, dentists can secure their future while continuing to thrive professionally.

1. Maximize Contributions to Tax-Advantaged Retirement Accounts

One of the most reliable ways to build retirement wealth is through maximizing contributions to tax-advantaged accounts such as 401(k)s, IRAs (Traditional and Roth), and SEP IRAs for self-employed dentists.

- 401(k) Plans: If you work in a group practice or have your own, consider establishing a 401(k) plan allowing you to contribute a significant portion of your income.

- SEP IRAs and Solo 401(k)s: Ideal for self-employed dentists, these plans offer higher contribution limits than traditional IRAs.

- Roth IRAs: Benefit from tax-free growth and tax-free withdrawals in retirement.

2. Diversify Investment Portfolios Beyond Dentistry

Relying solely on your dental practice for retirement income can be risky. Diversifying your personal investment portfolio with stocks, bonds, real estate, and mutual funds creates multiple income streams and buffers against market fluctuations.

3. Develop a Comprehensive Retirement Income Plan

It’s vital to have a clear retirement income plan that factors in all possible sources: Social Security benefits, pension (if any), rental income, investment withdrawals, and passive income.

Example Table: Potential Retirement Income Sources for Dentists

| Source | Estimated Monthly Income | Reliability |

|---|---|---|

| Dental Practice Sale Proceeds | $5,000 – $10,000 | Variable |

| 401(k)/IRA Withdrawals | $3,000 – $7,000 | High |

| Social Security Benefits | $1,200 – $2,000 | Moderate |

| Rental Property Income | $1,000 – $3,000 | Variable |

4. Manage Debt Aggressively

High student loans and business debts can delay retirement plans. Create a debt repayment schedule prioritizing high-interest debt. Consider refinancing options and avoid draining retirement savings to pay off short-term liabilities.

5. Plan the Dental Practice Exit Strategy Early

Many dentists’ biggest asset is their practice. Planning how and when to transition, whether via selling to a colleague, merging, or gradual phase-out, impacts retirement cash flow substantially. Hiring professional valuations and consulting with accountants can ensure you get fair value.

6. Invest in Professional Financial Advice

Financial planning for dentists shouldn’t be a solo venture. Certified financial planners (CFPs), especially those familiar with dental economics, can tailor retirement strategies, tax plans, and risk management specific to your career.

7. Create Multiple Passive Income Streams

Passive income offers an ongoing financial cushion post-retirement without active work. Dentists can invest in rental real estate, dividend-paying stocks, dental product endorsements, or even create educational courses for other dental professionals.

8. Protect Yourself With Appropriate Insurance

Insurance shields your financial health from unforeseen events. Maintain adequate disability insurance during your career, and consider long-term care insurance for retirement. Life insurance can aid in estate planning and protect your family’s financial future.

9. Monitor and Adjust Your Plan Regularly

Financial landscapes, tax laws, and life circumstances change. Schedule at least annual reviews of your retirement portfolio and plan. Adjust contribution levels, asset allocations, and income strategies to stay on track.

Benefits of Maintaining Financial Stability for Dentists

- Peace of Mind: Knowing your financial future is secure allows you to focus fully on caring for patients today.

- Early Retirement Flexibility: Possibility to retire earlier or semi-retire with less stress.

- Legacy Planning: Ability to pass on wealth or a thriving practice to heirs or charitable causes.

- Healthcare Security: Ensure coverage and funds to manage medical expenses as you age.

Practical Tips for Dentists Starting Retirement Planning Today

- Start early: The power of compound interest works best with time.

- Automate savings and investments to ensure consistency.

- Limit lifestyle inflation as income grows.

- Stay educated on changes in dental economics and retirement law.

- Encourage spouse or partner involvement to align goals.

Conclusion

Maintaining financial stability for retirement is a multifaceted endeavor that requires dentists to be proactive, informed, and disciplined. By leveraging these 9 proven strategies, dentists can confidently secure their financial future and enjoy retirement on their own terms. Remember, your financial health is just as important as oral health — plan wisely, invest intelligently, and consult trusted advisors to make the most of your retirement journey.

Start today by evaluating where you stand and committing to a tailored, sustainable financial plan. Your future self will thank you.