Standard Dental Labs Inc. (OTC: TUTH) Receives SEC Qualification for Regulation A Offering – PR Newswire

Standard Dental Labs Inc., a leader in dental manufacturing, has recently achieved a significant milestone by receiving SEC qualification for its Regulation A offering. This strategic move sets the stage for new investment opportunities and highlights the company’s growing influence in the dental industry. In this article, we will explore what this qualification means, its benefits, and how it could impact investors and the dental labs market.

Understanding the SEC Qualification and Regulation A Offering

The U.S. Securities and Exchange Commission (SEC) qualification is a critical regulatory approval that allows companies like Standard Dental Labs Inc. (OTC: TUTH) to offer securities to the public under Regulation A, a streamlined exemption from traditional registration requirements.

- What is Regulation A? Regulation A is an exemption under the JOBS Act that enables smaller companies to raise up to $75 million from the general public without undergoing the burdensome process of a full SEC registration.

- SEC Qualification: This step confirms the company’s offering circular meets SEC disclosure and transparency requirements, which protects investors and adds credibility.

- Offering Circular: Standard Dental Labs issued a detailed prospectus that outlines financials, risks, and use of funds, ensuring informed investment decisions.

Why This Is a Game-Changer for Standard Dental Labs Inc.

Being qualified by the SEC for a Regulation A offering expands Standard Dental Labs Inc.’s ability to attract a wide range of investors including retail investors who were previously unable to participate in private offerings.

- Enhanced Capital Raising: Enables the company to raise up to $75 million, fueling growth, equipment upgrades, and market expansion.

- Increased Market Visibility: SEC qualification often leads to increased media attention and investor awareness.

- Investor Confidence: Transparent disclosure and regulatory compliance give investors peace of mind.

About Standard Dental Labs Inc. (OTC: TUTH)

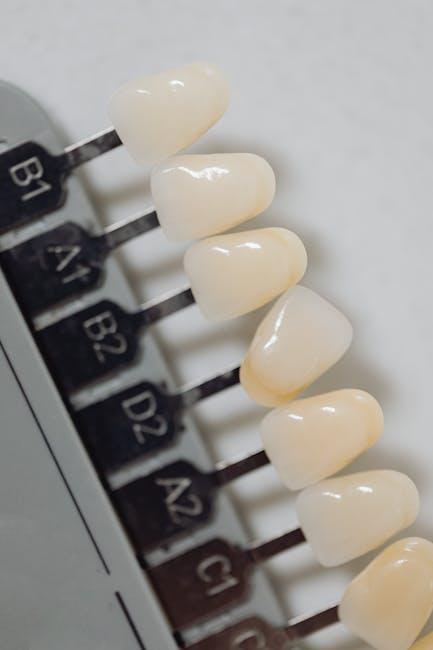

Standard Dental Labs Inc. is a pioneering company in the dental laboratory industry dedicated to providing high-quality dental prosthetics and restoration services. Their innovative manufacturing processes, coupled with the implementation of cutting-edge technology, enable dental professionals to deliver superior patient care.

| Company Feature | Details |

|---|---|

| Stock Symbol | TUTH (OTC) |

| Industry | Dental Manufacturing |

| Headquarters | San Diego, California |

| Products | Dental Prosthetics, Crowns, Bridges, Implants |

| Founded | 1997 |

Benefits of the Regulation A Offering for Investors and the Company

The SEC qualification approval for Standard Dental Labs’ offering not only eases fundraising but also unlocks substantial benefits for both the company and investors.

Benefits for Investors

- Access to Early-Stage Growth: Retail investors can participate early in a promising company’s expansion journey.

- Lower Investment Minimums: Regulation A offerings often have lower minimum investment amounts than traditional IPOs.

- Transparency and Regulatory Oversight: The company must disclose relevant financial information, fostering informed investment decisions.

Benefits for Standard Dental Labs Inc.

- Capital Infusion: Funds raised can accelerate innovation, scale production, and expand market reach.

- Broader Investor Base: Ability to attract retail investors and grow shareholder diversity.

- Brand Credibility: SEC approval elevates the company’s profile and reassures stakeholders.

Practical Tips for Potential Investors

If you are considering investing in the upcoming Regulation A offering by Standard Dental Labs, here are some practical tips to guide you through the process:

- Review the Offering Circular Carefully: Understand the company’s financials, risks, and business model before investing.

- Assess Your Investment Goals: Consider how this fits within your portfolio and risk tolerance.

- Consult Financial Advisors: Professional guidance can provide personalized insights and suitability analysis.

- Watch for Offering Dates: Stay updated through official press releases and the company’s investor relations page.

- Diversify: Avoid putting all your funds into one investment to mitigate risk.

Case Study: Regulation A Offerings Transforming Small-Cap Companies

Regulation A offerings have become a game-changer for many small to mid-cap companies in the dental and healthcare industries by enabling access to capital markets with fewer barriers.

| Company | Industry | Raised Capital | Post-Offering Growth |

|---|---|---|---|

| DentaCorp Labs | Dental Manufacturing | $50 million | Expanded into 5 new states, increased revenue by 40% |

| HealthTech Prosthetics | Medical Devices | $30 million | Launched new implant product line, improved margin by 15% |

This trend underscores the potential impact of Standard Dental Labs’ own offering on accelerating growth and innovation within the dental industry.

Conclusion

Standard Dental Labs Inc.’s recent SEC qualification for its Regulation A offering represents a pivotal advancement for the company and an exciting opportunity for investors. This regulatory approval establishes a strong foundation for raising substantial capital necessary to foster innovation and expand its market reach within the dental manufacturing sector.

Investors interested in the dental industry and early-stage growth should closely monitor Standard Dental Labs’ offering as it exemplifies a forward-thinking approach to public investment opportunities. Through clear disclosure, lower investment barriers, and diversified shareholder access, the Regulation A offering positions Standard Dental Labs Inc. as a promising player poised for future success.

For the latest updates, prospective investors can visit the official PR Newswire release and the company’s investor relations page.